I hope everyone is doing well and had a great holiday as we end the summer season. Thanks to all the new subscribers who joined since the last post. I am happy to announce that we now have more than 520 subscribers and 800+ followers in our community!

The last article I wrote about Shelly Group was one of the most popular and well-received writeups I created. Furthermore, the company's recent trajectory has made me even more excited about its future.

A good friend of mine from

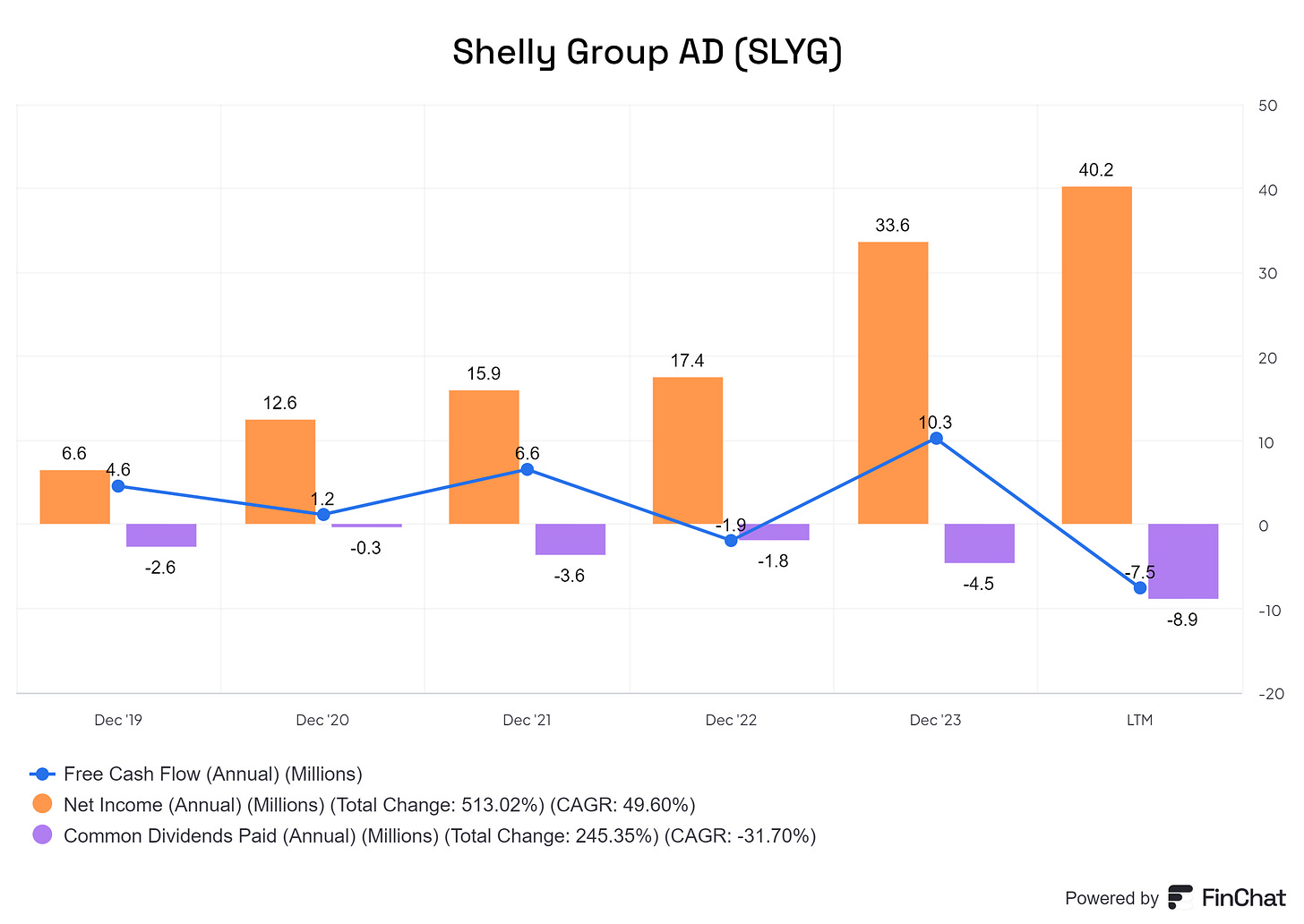

met with Wolfgang Kirsch, Shelly's co-CEO after he read my article. He was kind enough to share the notes with me. I will briefly go over what I haven’t written about yet.Lack of Free Cash Flow

When discussing FCF, or, to be exact, the lack of it even with very high net income profitability, Wolfgang passionately spoke about the need to be aggressive and as fast as possible to eliminate and dominate the competition. Shelly's sector is very, very, very competitive, so that is a bonus in my book.

A question that came to my mind here, though, is why they are paying out dividends. Can't they find opportunities to invest that money for a better return? If any of my readers knows the answer, please comment; I would love to discuss it!

Market size potential

Currently, 70-80% of Shelly’s customers are DIY enthusiasts, but the real opportunity lies in the professional installer market, which makes up 80% of the total market. If Shelly can effectively shift into this sector, we could see significant growth that the market hasn’t yet priced in. However, failure to penetrate this market could lead to stagnation.

Mistrust by the market

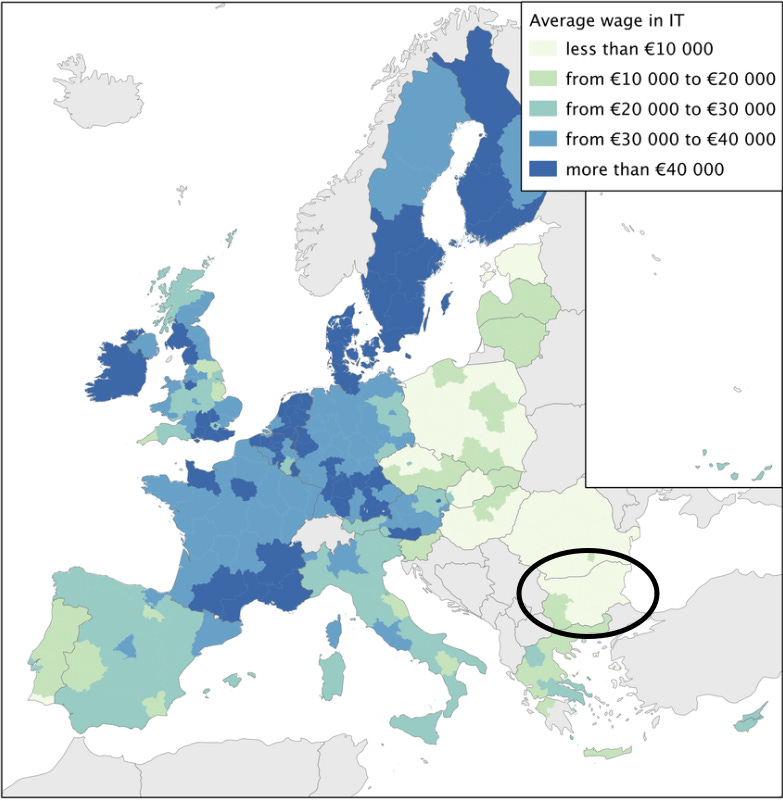

Since Shelly is a Bulgarian company, Wolfgang believes that the market assumes its numbers are too good to be accurate, so it trades at a “discount.”

Seeing the recent meteoric stock price rise, I'm unsure if I fully agree. Still, I believe that if we saw the same company in the USA, its valuation would be slightly different.

That’s why they are taking so many steps to increase investor confidence. They switched to Deloitte as an auditor, scheduled even more investor conferences, and continued using the best practices to increase Shelly’s visibility.

New catalysts

It’s interesting because before hearing about it from the CEO, I didn’t think about it too much.

Shelly has a market cap of only around $620 million. That means most sizable funds can’t invest in it no matter how much they like it. The low float caused by founders not wanting to divest doesn’t help either.

Wolfgang believes that as they cross the $1bn mark, institutional investors will start noticing Shelly and will be able to invest in it. When the stock reaches >€200-250 million free float, it should be included in the SDAX index, increasing investor interest further.

”In the medium term, the Shelly Group aims to meet the critical qualification criterion of market capitalization of freely tradable shares for inclusion in the SDAX." - Wolfgang.

More China risk than I initially thought

This didn’t come from Wolfgang, but some more digging.

Even though I talked about how their chip and factory operations outside of China add diversification, that doesn’t mean they don’t have any.

I discovered that they make the chip that powers many of their devices with TSMC TSM 0.00%↑ , but almost all the metals needed for that specific chip are primarily found in China.

If sanctions were to increase or China would get into a war with Taiwan, even outside factories wouldn’t help that much, as they would need to change their chip core composition.

High scale R&D

Shelly does all of the research and development in-house in Sofia, Bulgaria. This allows them to save A LOT of money on people and hire more to increase capabilities. Sofia is becoming a real tech hub, with many companies outsourcing their research talent there.

According to him, the quality of talent here is very high, and salaries are 1/3 of those of other countries. Wolfgang believes this makes them more efficient and intends to keep these operations there.

Shelly is a startup in an old company “shell” (pun intended)

All of my readers know that Shelly is a 20-year-old company that is very quick to adapt to new changes, and that is why we still regard it as a startup. We all know how fast they can change, but Wolfgang gave this example to show that their product development is just as fast.

“At Shelly, the time it takes for a product to go from an idea to a launch is 6 months; at Schneider (one of their biggest competitors), an idea to a PowerPoint formal pitch to management takes 6 months“.

This could be an exaggeration, but from what I’ve seen with companies this size, that may very well be close to the truth.

As long as Shelly's startup culture survives (Wolfgang is a big cultivator of it), it can better overcome most market struggles than the competition.

On USA expansion

As mentioned in the first quarter management call, Shelly is actively searching for acquisition opportunities to expand in the United States. However, they are cautious about their capital allocation, so that takes time.

Wolfgang also mentioned that “Europe is driven by efficiency and regulations, the United States—security.” Both are very different and large markets that Shelly can take with time.

Sale of Shelly Group

They are not currently considering selling a larger portion of the company to strategic or other investors (especially competitors). They believe the company can easily be at least 5x larger in the coming years and thus don’t want to sell anything now.

After 4-5 years, Wolfgang hinted that they would be ready for a sale. As they have a very close connection and compatibility with Amazon, they could be one of the buyers with a lot of cash for the acquisition.

On Vodafone and African telecom deals

Most industry companies (especially in Africa) need to measure their energy consumption and thus are becoming increasingly aware of Shelly. Wolfgang believes that this could be a massive long-term opportunity in the business space, and personally, I think that diversifying across customer types could be very beneficial to Shelly, too!

That’s it for today! As always, thank you for your support, and I look forward to hearing from you! Be sure to check out

, the quality of research there is amazing!