It's hard to stop Kinsale Capital

An overview of the efficiency king of the E&S (excess&surplus) insurance market

"Buy once, cry once" is a quote by the famous British fund manager Terry Smith, who has returned around 15% to investors annually over 14 years. This quote, I believe, summarises my thought process when I was buying Kinsale Capital Group. This company is not a value play, a turnaround bet, or an exciting hedge fund niche play. It is a very simple and efficient compounder (basically invest and let it run). In this article, I’ll try to show why I think the company will be able to continue its trajectory and discuss the risks involved.

Overview

Market cap: $10.48B

Price: 450$

Year founded: 2009 (IPO - 2016)

Founder/CEO: Michael Kehoe (more about him later on)

CAGR since IPO: 51.2%

Kinsale Capital Group is a specialty property/casualty insurance company, that provides E&S (excess&surplus) insurance products in the United States. It markets and sells them in all 50 states. Through its extensive and market-leading processes, Kinsale manages to shift the “High risk - high reward“ balance in its favor.

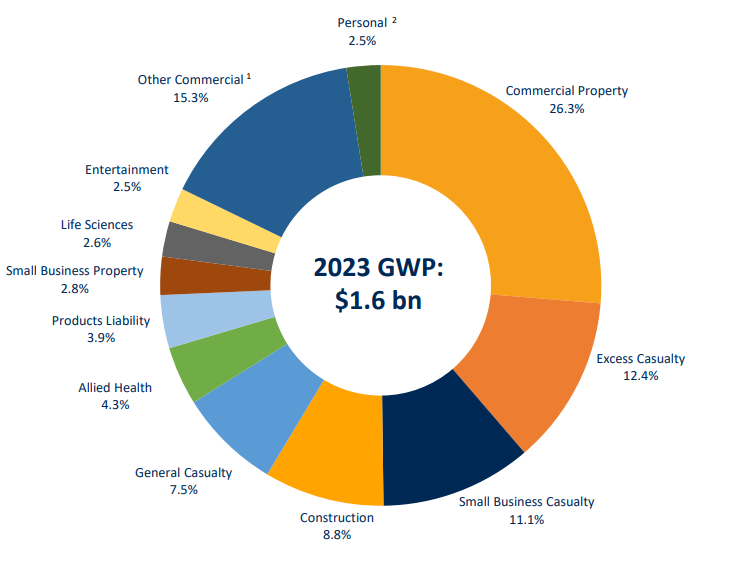

Segments and diversification

There is not much that can be said about Kinsales’ portfolio except that they practice great diversification across multiple industries.

Note: some of the biggest Kinsales’ clients are commercial properties and small businesses. As interest rates go down, the financial risks of these clients will decrease.

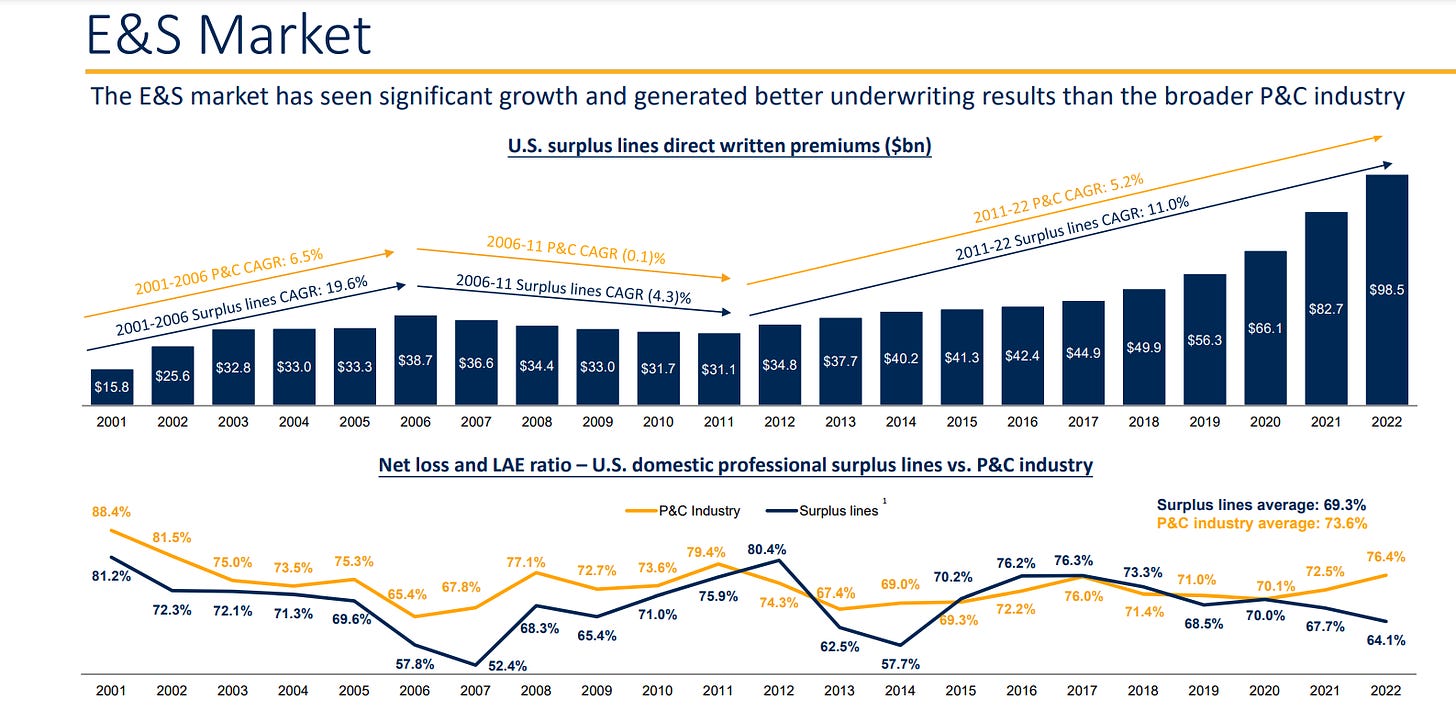

E&S industry

Simple description: if you cannot get proper insurance through traditional insurers because of a hard-to-value risk or too much uncertainty, you can go to the E&S insurance companies who will provide you insurance in return for higher premiums.

In traditional insurance businesses risk management is super important but in the E&S industry, it’s THE KEY THING. Those, who manage it well and have proper processes built in place, can reap the gains of the high-risk investments, and those, who stumble, get wiped out quickly.

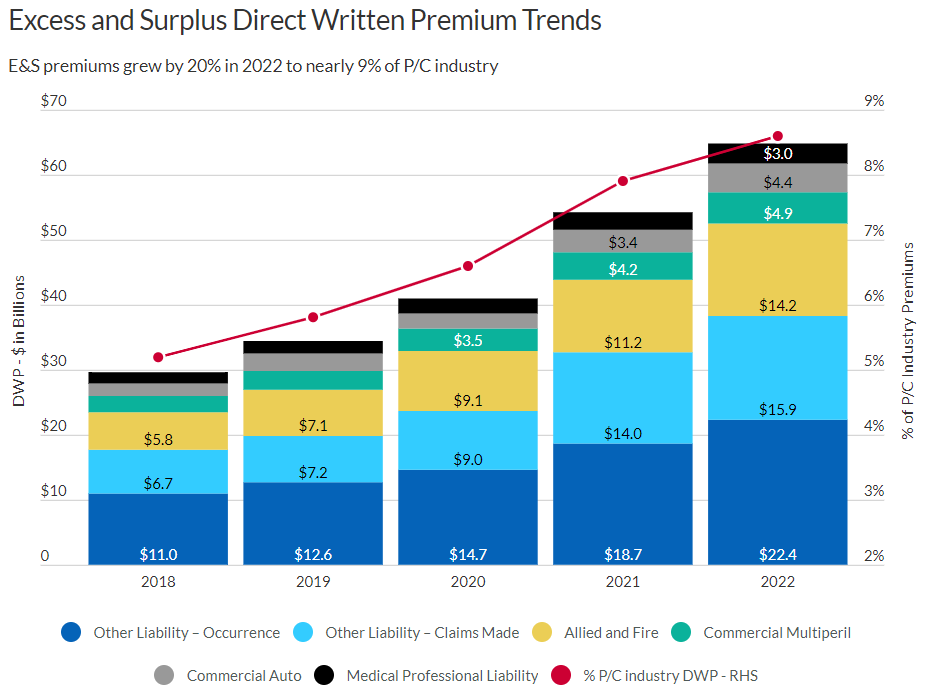

The size of the E&S market compared to the property/casualty market as a whole is around 9% (Fitch source here) and is expected to grow at around 11-15% annually until 2027.

Logically, the E&S market has much higher growth rates (and obviously - decline rates in unfavorable markets).

The whole E&S sector experienced tremendous growth since 2018 after many more conservative insurance brokers started shedding more risky contracts as a response to more unpredictability in the USA climate and overall stability shift.

How does Kinsale Capital stack up?

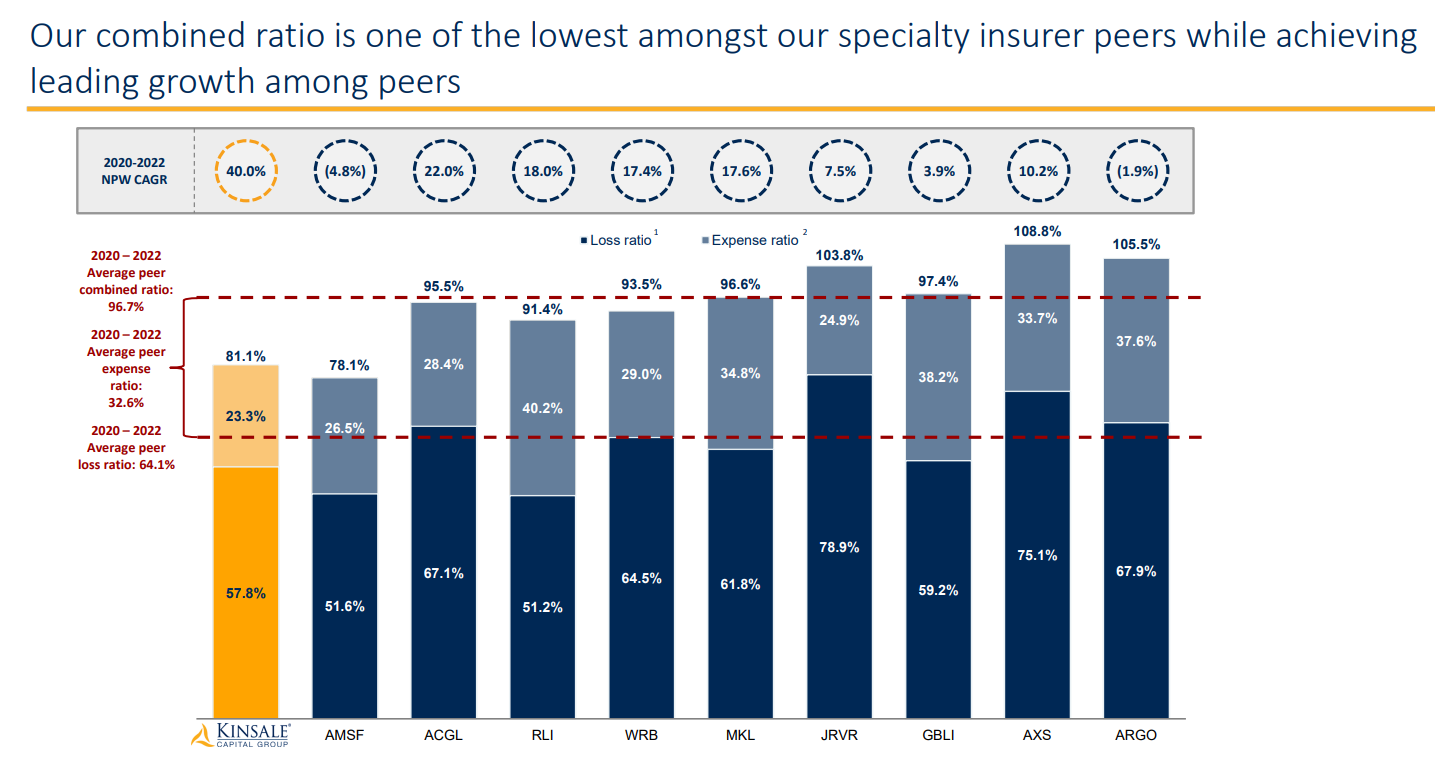

Kinsale Capital is an efficiency machine. That is achieved by:

Making all underwriting decisions in-house (lots of insurance players outsource this part, destroying the incentives to perform as well, since bonuses are paid on a scale but not profitability basis + relying on others to manage your risk)

Relying on quantitative in-house models to make the most important decisions

Focus on smaller accounts eliminates much of the competition, increases profit margins, and diversifies the client portfolio. The high volume model is hard to implement by other insurance businesses without proper quant methods which increases Kinsales’ moat.

All this leads to one of the best combined ratios (money flowing out in the form of expenses, and losses) in the market. The lower, the better.

Kinsale: 81.1%

Property & Casualty market: 101.1%

Excess & surplus market: 96%

They have achieved this while growing premiums at 40%+ annually.

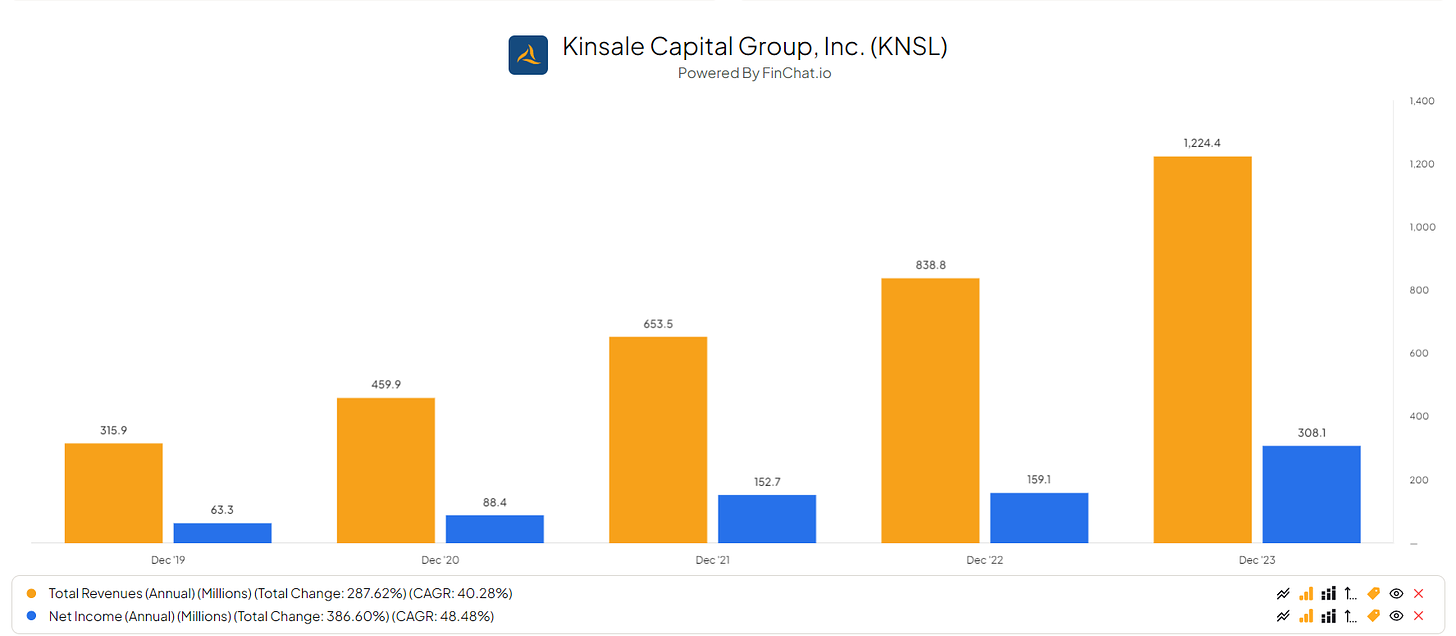

Kinsales’ financials reflect this:

Underwriting margin: 45.8%

Net margin: 25.2% (most insurance brokers have 2-5% margins, making it more prone to collapse if a force-majeure happens)

2023 ROE: 33.6% (historical average: 20.3%)

ROCE: 25.7%

Revenues and net income:

Management

Michael Kehoe has been the CEO since founding the firm in 2009.

Prior he ran James River Insurance Company from 2002 to 2008.

Interesting listen to see how he thinks about risk management. One of the more interesting points that he mentions is that they lose a couple of percent of potential profit per year just to manage their risk over the long horizon.

Ownership stake: 4.1% ($480M which is almost all of his net worth).

Both COO and CFO have been with the company since its founding.

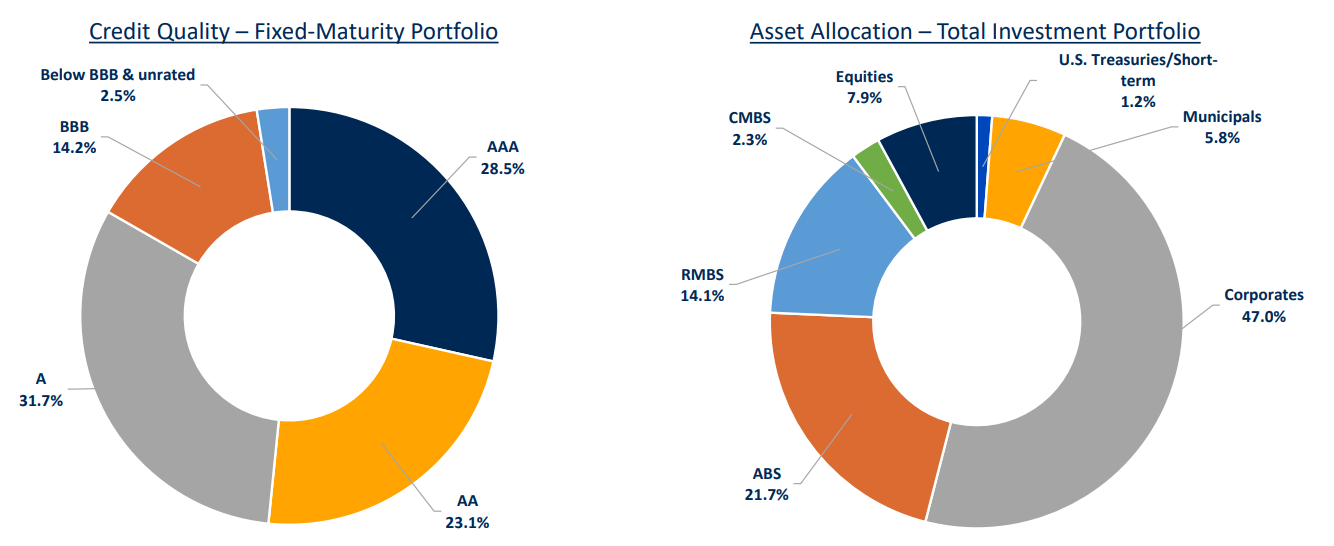

Kinsale Capital investment portfolio

Portfolio value 2023: $2.95B

Do you know why Buffett was so successful? He managed to use Geicos’ free cash as leverage and delivered outsized returns as his investments outperformed the market.

These are the reasons why Kinsale does not do the same:

Risk management

Geico has a much lower clientele risk profile which allows them to take on more risk through investing in equities. Kinsale focuses on already risky clientele and if they were to invest like Buffet (who had -50% drawdowns multiple times), that would just be foolish. Balance is necessary!

Investing skill

Warren Buffet is one of the most successful investors in the world. I don’t think it would be smart of Kinsale to try to imitate him or even outperform the S&P 500 thus sticking to a balanced portfolio makes sense.

Note: I see many people thinking that as interest rates go down, Kinsales’ investing returns will disappear. That is not the whole picture.

Kinsale has a pretty balanced portfolio with treasuries + municipals being only a 7% position. Their corporate bonds and equities portfolio will be a little bit less sensitive to interest rates than people think. Of course, in a couple of years corps will not pay out as much but we can expect them to shift strategies with a changing macro climate.

How important is investing for Kinsale?

Their investment income has historically been between 2-9% of their total revenues, meaning that a couple percent lower investment income will not significantly impact the stock price.

Risks

Growth

If you look at the chart of the stock price since the start of the year, you will see a wild ride. +25% on earnings, and -12% past month. This occurred because of an analyst downgrade due to assumptions that a soft market is coming and premium price increases across the industry will not grow as they have since 2018. There is nothing wrong with the company intrinsically but just means that we have to adjust expectations and thus - valuation.

Worsening climate predictability

Long-term, climate-caused damage will become more severe, widespread, and unpredictable. This is not a problem for just Kinsale but for the whole insurance industry as well.

Black swans

It is interesting that the CEO left James River Insurance during the 2008 financial crisis. Because of a comparably short company operating time, we cannot see how Kinsale performs during rare financial catastrophes. Even though the CEO always says that they are super disciplined when it comes to risk management, investors have to see how that works out during difficult times.

Maybe it is possible to see the durability of Kinsale when looking at the 2020 crash but I still believe that we need a serious financial crisis to truly test Kinsale - hopefully, that won’t happen :)

AI

Even though improving AI can help Kinsale improve its quantitative decision-making, it also helps to level the field for Kinsales’ competitors. This COULD result in a moat decrease.

Insurance brokers concentration

In 2023, Kinsale distributed 58.5% of its gross written premiums through 5 of its 179 brokers. This gives the brokers leverage which is never good in a business.

Opportunities & strengths

Strong fundamentals

Kinsale Capital has one of the best combined ratios in the market, ROE, margins, a unique quantitative edge, which allows them to reach the usually not interesting to big players small accounts, and a highly capable management team. I believe this will allow Kinsale to continue leading the E&S space.

Market share expansion

Currently, Kinsale holds a 1.1% market share of a $98B fast-growing market. I truly believe that with their unparalleled efficiency, they will be able to capture market share from the competition.

Uncertainty

Knowing Kinsale, they will turn the risk of uncertainty into an opportunity for growth. As more competitors will retract from more risky segments of the insurance industry, Kinsale will come, and pick up the safe parts of the risky segment for tremendous profits.

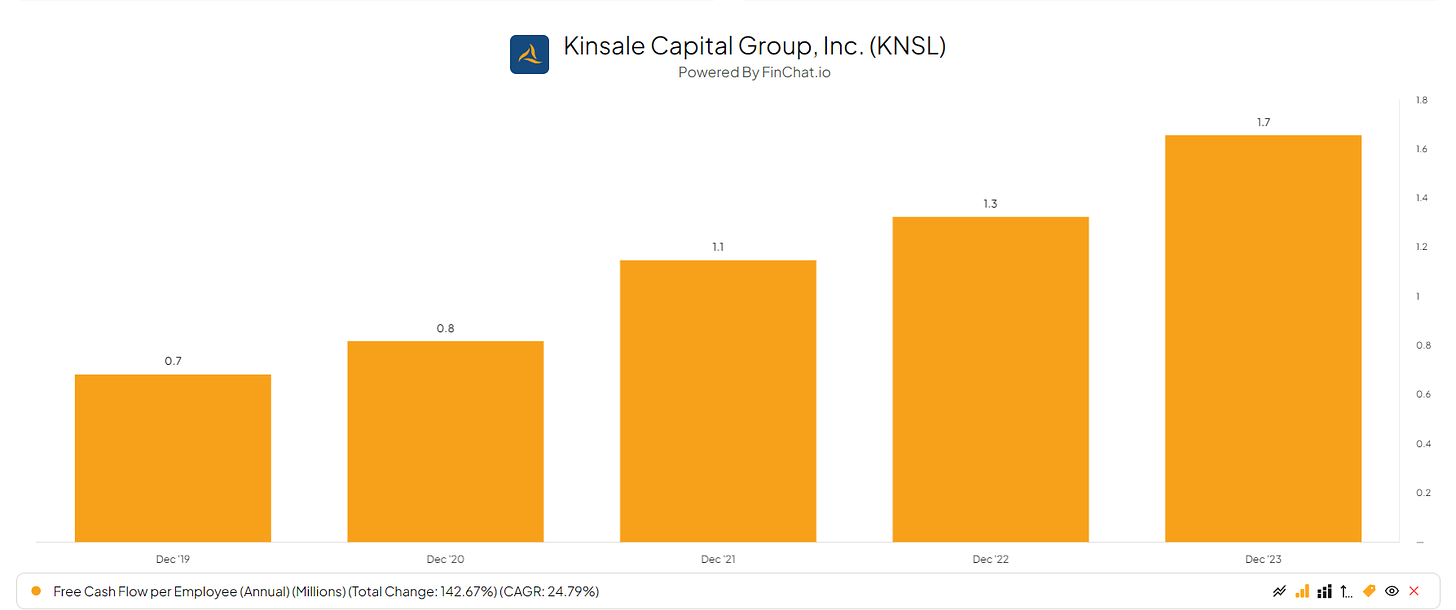

High scalability

Look at this chart of FCF/employee. Because of their automated processes, they are able to scale exponentially.

Balance sheet check

Not gonna dive too deep here except just give a safety check.

Let’s look at some metrics:

Cash: $126.7M

Total debt: $183.8M

Interest coverage: 38.28!

Debt/equity: 0.17

Valuation

Historical median P/E ratio: 38.23

TTM P/E: 34.12 (10% lower)

Forward P/E: 29.41 (20% lower)

3 yr. analyst EPS growth CAGR: 23.3%

3 yr. analyst revenue growth CAGR: 24.2%

This stock in no way, shape, or form is cheap. In my DCF, I got that the stock is trading around 10% below fair value. I will continue holding on to Kinsale but you have to remember that it is a much different decision to buy a stock at a premium valuation than to hold on to your best performer.

All this said, I leave you to do your own dd but hope that I managed to give you a thorough overview of this exceptional company.

Thanks a lot!

If you were able to ask the CEO a question about the company what would you want to know?